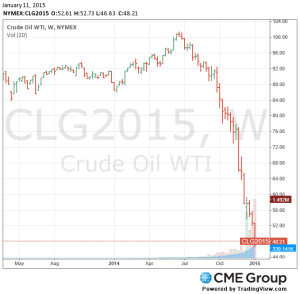

Unless you’ve just crawled out from under a rock, you’re well aware that the price of oil has declined over the past six months and, with it, the cost of energy. You see it when you fill up your vehicle with gasoline or when you pay your fuel bill to heat your home (unless you’re among the unfortunate who locked in a fixed price before the recent price collapse).

Unless you’ve just crawled out from under a rock, you’re well aware that the price of oil has declined over the past six months and, with it, the cost of energy. You see it when you fill up your vehicle with gasoline or when you pay your fuel bill to heat your home (unless you’re among the unfortunate who locked in a fixed price before the recent price collapse).

If you run a business, you’re even more familiar with this price change, including its effects on your bottom line. The change has impacted producers, marketers, and users. However, just because prices have plummeted does not mean that risk–and opportunity–have vanished. That proverbial horse may already have left the barn, but there are more awaiting their own escape. If you have a future interest in a commodity, the uncertainty of its price will always present you with the counterbalancing risk/opportunity dynamic. Rather than simply wallowing in the anguish of lost profits–or basking in the glow of unexpected gains–perhaps it’s time to move on, to consider what opportunities this new pricing environment presents for the future.

In this article, I’ll consider the implications of current market prices for producers. Producers have a reasonably predictable cost of production, which does not change dollar for dollar with changes in energy prices. Therefore, absent hedging, when prices rise, their margins tend to expand, dropping straight to their bottom line. When prices fall, margins are compressed. When the price environment changes as radically as it has in the past six months, it’s time for a reassessment of one’s position and strategy.

Strategic ideas for energy producers:

1. Cash up paper gains early. Have you already realized substantial gains on financial derivatives that you used to lock in selling prices before the recent price decline? Is it time to cash in on those gains? Don’t create more risk by closing needed derivatives prematurely, but if your remaining risk is marginal, it may be timely to close your contracts if you can.

2. Use options to lock in gains. If you are concerned about the price of energy bouncing substantially from these price levels and losing some of your locked-in gains, consider converting short positions to long put options. Or, rather than closing your short positions, simply purchase call options on a speculative basis. Either practice will effectively lock in the gains on your short paper positions. If prices rebound, you’ll experience a windfall.

3. Suspend producing operations. Is it still profitable for you to continue producing energy in the new pricing environment? If not, consider curtailing or suspending operations to control cost and risk. More favorable pricing may await you down the road.

4. Lock in your cost. Chances are, if you’re an energy producer, you’re also an energy user. Do the current costs offer you price levels below budget? Consider locking in your cost with long futures, swaps, forwards, or call options.

In my next article, I will share some ideas for the middleman, the marketer.